Can You Do Taxes With Last Pay Stub? Here's What You Need To Know

So, you're wondering if you can file your taxes using just your last pay stub. It's a common question, especially for folks who don't have access to their W-2 or other official tax documents. Well, let me break it down for you in a way that's easy to understand. Taxes don’t have to be this big scary monster, and your last pay stub might actually hold more power than you think. Stick with me, and I'll walk you through everything you need to know about using your final pay stub for tax purposes.

Now, before we dive deep into the nitty-gritty, let’s set the stage. Taxes are basically the government’s way of saying, “Hey, we need a little piece of your income to keep everything running smoothly.” It’s not optional, but it doesn’t have to be complicated either. If you’re missing your W-2 or other important tax forms, your last pay stub can act as a lifeline. But there’s a catch—there’s a right way and a wrong way to use it.

Let’s not sugarcoat it. Filing taxes without your W-2 can feel like navigating a maze blindfolded. But hey, life happens, and sometimes we don’t always have the exact paperwork we need. That’s where your last pay stub comes in. While it’s not a replacement for your W-2, it can still provide crucial info that helps you estimate your annual income and deductions. So, buckle up, because we’re about to break it all down step by step.

- 7movierulz The Ultimate Guide To Staying Updated On Latest Movie Releases

- Jazmyn Bieber The Rising Star Whos Making Waves In The Music Scene

Understanding Your Last Pay Stub

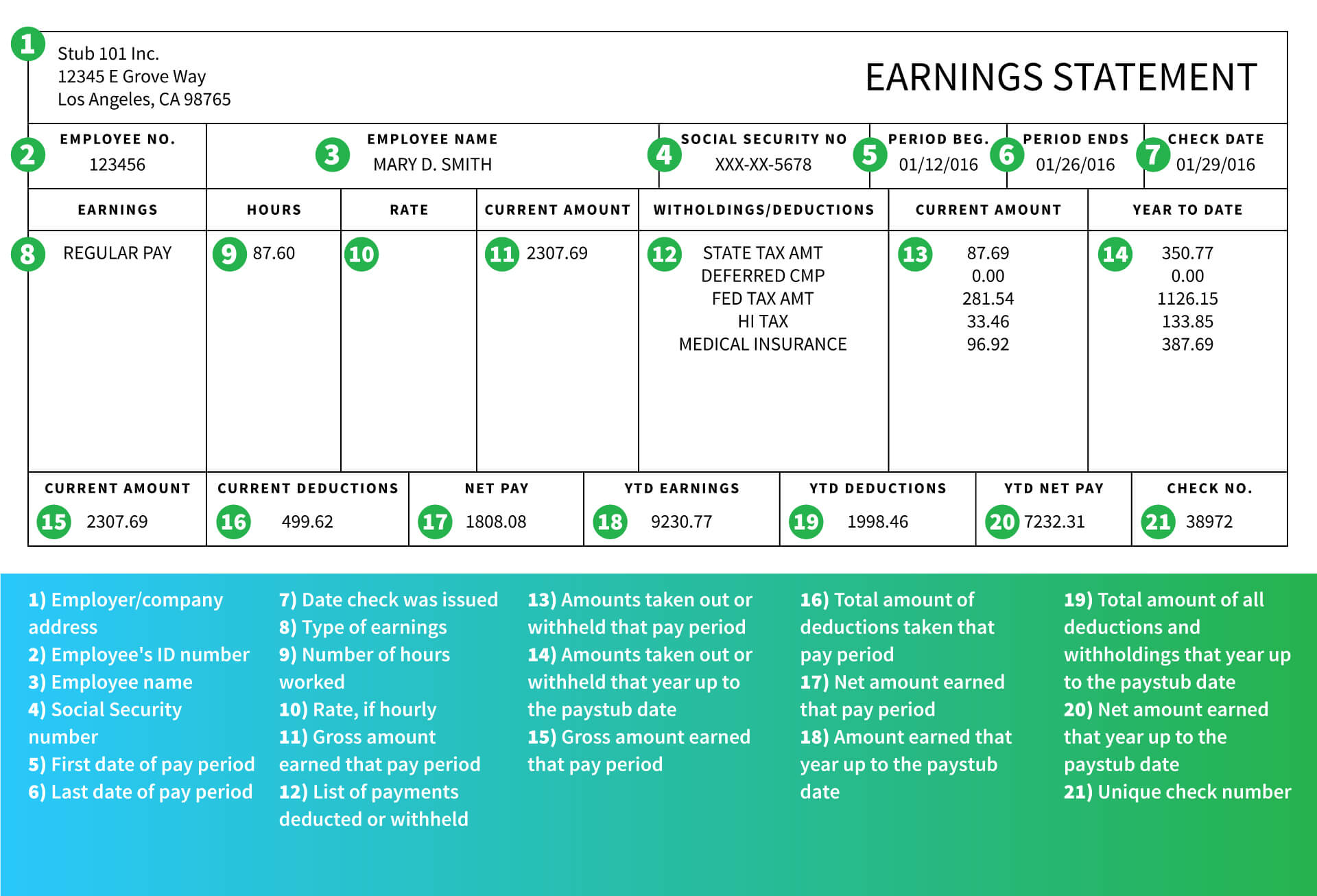

First things first, let’s talk about what exactly a pay stub is and why it matters when it comes to taxes. Your pay stub is like a mini financial snapshot of your paycheck. It shows how much you earned, how much was taken out for taxes, and other deductions. Think of it as a receipt for your hard work. And guess what? That last pay stub you received before the year ended can give you a lot of clues about your total income for the year.

What Information Does a Pay Stub Provide?

Your pay stub is packed with info, and here’s a quick breakdown of what you’ll typically find:

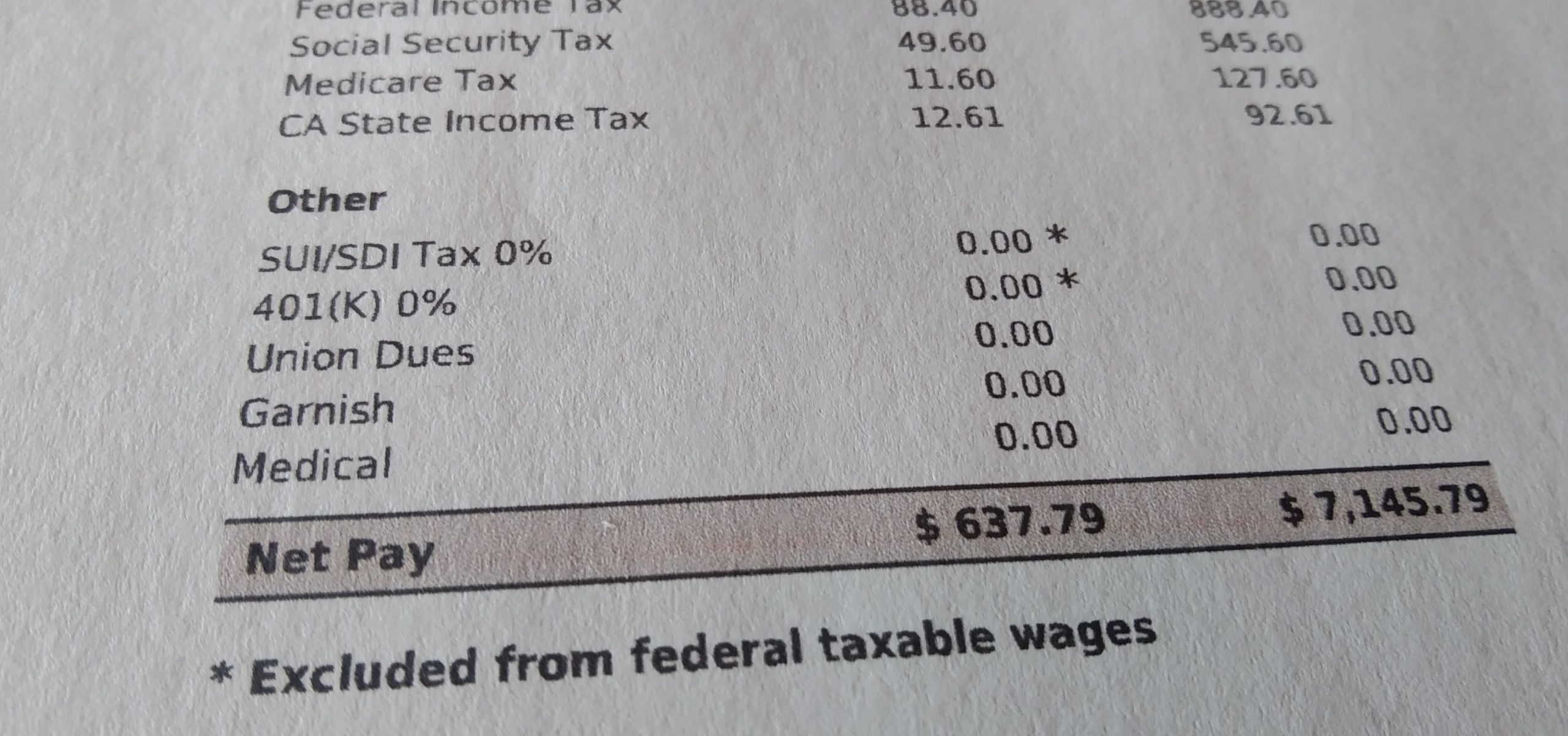

- **Gross Pay**: This is the total amount you earned before taxes and deductions.

- **Net Pay**: This is the amount you actually take home after all the taxes and deductions are taken out.

- **Federal and State Taxes**: These are the amounts withheld for federal and state income taxes.

- **Social Security and Medicare**: These are mandatory contributions to social programs.

- **Other Deductions**: This could include things like health insurance, retirement contributions, or union dues.

So, when you're trying to figure out if you can do taxes with your last pay stub, these details are gold. They help you estimate your annual income and deductions, which are key components of your tax return.

- Unleashing The Power Of Ibomma Movies Your Ultimate Guide To Streaming Bliss

- Movierulz 2023 Your Ultimate Guide To Telugu Movies Download Via Ibomma

Can You File Taxes With Just a Pay Stub?

Here’s the deal: technically, you can’t file your taxes using just your last pay stub. The IRS requires an official W-2 form to verify your income and tax withholdings. But if you don’t have your W-2, your pay stub can serve as a temporary solution. It’s kind of like using a spare tire when your main one goes flat—it gets you where you need to go until you can replace it with the real thing.

Using your last pay stub to estimate your income is a smart move if you’re in a pinch. You can input the info from your pay stub into tax software or give it to your accountant, and they can help you file an accurate return. Just remember, it’s not a permanent fix. If the IRS notices that your pay stub info doesn’t match your W-2, they might come knocking. So, always follow up with your employer to get that official W-2 as soon as possible.

Steps to Estimate Your Income Using a Pay Stub

Ready to use your last pay stub to estimate your income? Here’s a simple step-by-step guide:

- **Find Your Gross Pay**: Look for the gross pay amount on your pay stub. This is your total earnings before taxes.

- **Multiply by the Number of Pay Periods**: If you’re paid weekly, multiply the gross pay by 52. For bi-weekly pay, multiply by 26. This will give you an estimate of your annual income.

- **Check Deductions**: Review the deductions section on your pay stub. This will help you estimate how much was withheld for taxes and other contributions.

- **Input Into Tax Software**: Use tax software or consult with an accountant to input this info and generate an estimated tax return.

By following these steps, you can get a pretty good idea of what your tax situation looks like, even without your W-2. It’s not perfect, but it’s a solid starting point.

Why Your W-2 Matters

Alright, let’s talk about the W-2 for a sec. The W-2 is basically the holy grail of tax documents. It’s the official form that your employer sends to the IRS and to you, detailing your annual income and tax withholdings. Without it, filing your taxes is like trying to bake a cake without a recipe—you might get close, but it’s not gonna be perfect.

Here’s why the W-2 is so important:

- **Accurate Income Reporting**: The W-2 ensures that the income you report matches what your employer reported to the IRS.

- **Verification of Tax Withholdings**: It confirms how much was taken out of your paycheck for federal and state taxes.

- **Avoiding Penalties**: Filing without a W-2 can lead to discrepancies, which might result in penalties or audits down the line.

So, while your last pay stub can help you estimate your income, it’s no substitute for the real deal. Always prioritize getting your W-2 if you can.

What to Do If You Don’t Have a W-2

Life happens, and sometimes you just can’t get your hands on that W-2. Maybe your employer lost it, or maybe they haven’t sent it out yet. Whatever the reason, don’t panic. There are steps you can take to ensure you file your taxes accurately:

- **Contact Your Employer**: Reach out to your HR department or payroll team to request a copy of your W-2.

- **File Form 4852**: If your employer can’t provide a W-2, you can file Form 4852 with the IRS. It’s basically a substitute W-2 that lets you estimate your income and withholdings.

- **Use Your Last Pay Stub**: Until you get your W-2 or file Form 4852, use your last pay stub to estimate your income and deductions.

Remember, the IRS is pretty understanding about these things. As long as you make a good-faith effort to report your income accurately, they’ll work with you to get everything sorted out.

Common Reasons for Missing a W-2

Here are some common reasons why you might not have received your W-2:

- **Employer Error**: Sometimes employers make mistakes and forget to send out W-2 forms.

- **Change of Address**: If you moved recently, your W-2 might have been sent to your old address.

- **Lost in the Mail**: It happens. Mail gets lost, and W-2 forms are no exception.

Whatever the reason, don’t let it stop you from filing your taxes. Use your last pay stub as a backup plan, and follow up with your employer to get that W-2 ASAP.

How to File Taxes Without a W-2

If you’re still waiting on your W-2, don’t let it hold you back from filing your taxes. Here’s how you can proceed:

1. **Estimate Your Income**: Use your last pay stub to estimate your annual income and deductions.

2. **File Form 4852**: Complete and submit Form 4852 to the IRS as a substitute for your missing W-2.

3. **Consult a Tax Professional**: If you’re unsure about anything, don’t hesitate to reach out to a tax accountant or advisor. They can help you navigate the process and ensure everything is done correctly.

By taking these steps, you can still file your taxes on time, even without your W-2. It’s not ideal, but it’s doable.

Using Tax Software Without a W-2

Most tax software programs, like TurboTax or H&R Block, allow you to file your taxes without a W-2. They’ll guide you through the process of estimating your income and deductions using your last pay stub. Just be sure to double-check all the numbers before submitting your return.

And remember, if the IRS notices any discrepancies, they’ll let you know. It’s not the end of the world, but it’s always better to be as accurate as possible from the start.

Common Mistakes to Avoid

When using your last pay stub to file your taxes, there are a few common mistakes to watch out for:

- **Underestimating Your Income**: Make sure you’re multiplying your pay stub numbers correctly to get an accurate estimate of your annual income.

- **Forgetting Deductions**: Don’t forget to include all your deductions, like Social Security and Medicare contributions.

- **Not Following Up on Your W-2**: Always keep pressing your employer for that official W-2. It’s the only way to ensure your tax return is 100% accurate.

Avoiding these mistakes will save you a lot of headaches down the road. Taxes are tricky enough as it is—don’t make it harder on yourself by cutting corners.

Conclusion

Alright, let’s wrap this up. Can you do taxes with your last pay stub? The short answer is yes, but it’s not a perfect solution. Your pay stub can help you estimate your income and deductions, but it’s no substitute for an official W-2. Always prioritize getting your W-2 if you can, and use Form 4852 as a backup plan if necessary.

Remember, filing taxes doesn’t have to be scary. With the right tools and a little bit of effort, you can get it done efficiently and accurately. And if you’re ever unsure, don’t hesitate to reach out to a tax professional for help.

So, what are you waiting for? Grab that last pay stub, estimate your income, and get those taxes filed. You’ve got this!

And hey, if you found this article helpful, drop a comment or share it with a friend. Let’s spread the tax knowledge and make life a little easier for everyone!

Table of Contents

- Understanding Your Last Pay Stub

- Can You File Taxes With Just a Pay Stub?

- Why Your W-2 Matters

- What to Do If You Don’t Have a W-2

- How to File Taxes Without a W-2

- Common Mistakes to Avoid

- Conclusion

- Hidden Gems Streaming Unveiling The Best Underrated Content On The Web

- Movie Rulz Telugu Movies Find What You Seek Now

How to File Taxes With Last Pay Stub Expert Tips and Tricks No. 1

Can You File Your Taxes With Your Last Pay Stub

Understanding Different Pay Stub Abbreviations