See The Way I See Net Worth: Unlocking The Secrets To Financial Success

Let me tell you something right off the bat—net worth isn’t just a number on a spreadsheet or a figure that makes headlines. It’s a reflection of who you are, your journey, and the decisions you’ve made along the way. When we talk about "see the way I see net worth," we’re diving deep into understanding what it truly means to build wealth, not just for the sake of dollars and cents, but for the life you want to live. So grab a coffee, sit back, and let’s unravel this together.

You might be wondering why net worth matters so much. Well, it’s not just about having more zeros in your bank account. It’s about creating financial freedom, security, and the ability to chase your dreams without constantly worrying about money. Understanding your net worth is like peeling back the layers of an onion—there’s more to it than meets the eye. And trust me, it’s worth the effort.

Now, before we dive headfirst into the nitty-gritty, let’s get one thing straight: building net worth isn’t a sprint. It’s a marathon. It requires patience, discipline, and a mindset shift. But don’t worry, I’m here to guide you through it. By the end of this article, you’ll have a clearer picture of how to "see the way I see net worth" and start building a financial future that aligns with your values and goals.

- Movies More Whats Hot What To Watch Where To Stream

- Why Ibomma Telugu Movies New 2022 Is The Ultimate Hub For Film Lovers

Here’s the deal—this article is packed with insights, strategies, and actionable tips to help you navigate the world of net worth. Whether you’re just starting out or looking to take your financial game to the next level, there’s something here for everyone. So, without further ado, let’s get into it!

Table of Contents

- What is Net Worth?

- Why Net Worth Matters

- How to Calculate Your Net Worth

- Common Mistakes People Make with Net Worth

- Building Your Net Worth

- Investing for Net Worth Growth

- Net Worth and Your Lifestyle

- Celebrity Net Worth: Lessons to Learn

- Setting Net Worth Goals

- Conclusion

What is Net Worth?

Alright, let’s break it down. Net worth is basically the difference between what you own (assets) and what you owe (liabilities). It’s the financial snapshot of where you stand at any given moment. But here’s the kicker—net worth isn’t just about money. It’s about the choices you make, the investments you prioritize, and the lifestyle you lead.

Breaking Down Assets and Liabilities

Assets are anything that adds value to your life—your house, your car, your investments, even that vintage guitar collecting dust in the corner. Liabilities, on the other hand, are the things that cost you money—mortgages, loans, credit card debt, you name it. The key is to have more assets than liabilities, but it’s not always that simple.

- Unveiling The Secrets Of Masahub2 The Ultimate Guide Yoursquove Been Waiting For

- Filmy4wap Xyz Com Your Ultimate Guide To Streaming And Downloading Movies

Let me drop a little wisdom here—your net worth isn’t just about the numbers. It’s about the story behind them. Are you building wealth for the right reasons? Are you making choices that align with your long-term goals? That’s what "see the way I see net worth" is all about.

Why Net Worth Matters

Here’s the thing—net worth matters because it gives you a clear picture of your financial health. It’s not just about how much money you have in the bank; it’s about your overall financial well-being. When you know your net worth, you can make smarter decisions about your money, your career, and your life.

Think of it like this—your net worth is like a compass. It points you in the right direction, helping you stay on track with your financial goals. Whether you’re saving for retirement, planning a dream vacation, or building a business, knowing your net worth is the first step toward success.

The Psychological Impact of Net Worth

There’s something powerful about understanding your net worth. It gives you a sense of control and empowerment. You start to see money not as a source of stress, but as a tool to create the life you want. And that’s a game-changer.

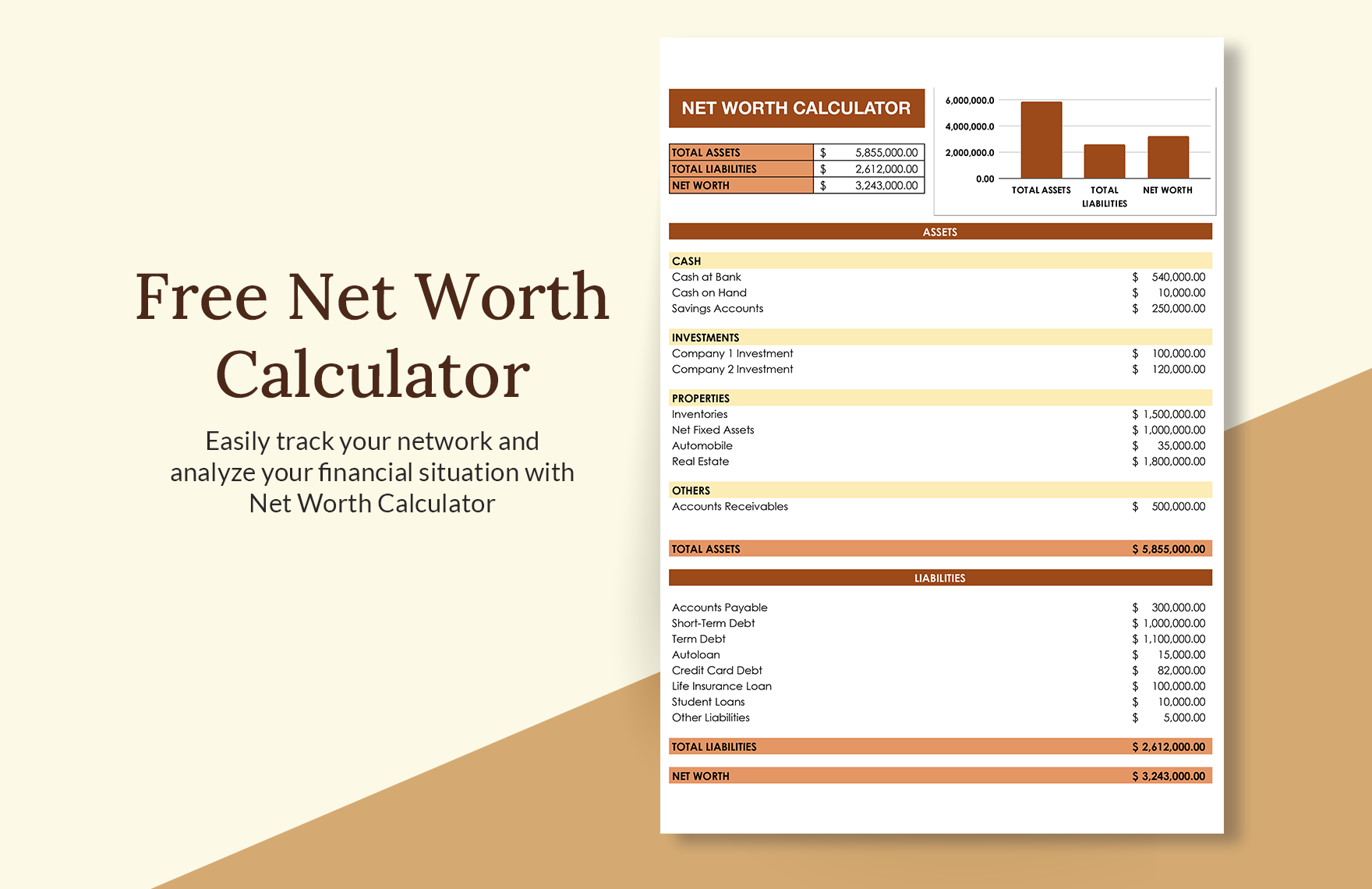

How to Calculate Your Net Worth

Calculating your net worth isn’t rocket science, but it does require a bit of effort. Here’s the formula: Net Worth = Assets – Liabilities. Simple, right? But let’s dive a little deeper.

- Assets: Include everything from your savings account to your retirement funds, property, and investments.

- Liabilities: Add up all your debts, including mortgages, student loans, and credit card balances.

Once you’ve got those numbers, subtract your liabilities from your assets, and voilà—you’ve got your net worth. But here’s the thing—it’s not just about the number. It’s about understanding what it means and how you can improve it.

Tips for Accurate Calculation

Here are a few tips to make sure your calculation is as accurate as possible:

- Update your numbers regularly—monthly or quarterly works best.

- Be honest about your liabilities. Don’t sugarcoat the debt you owe.

- Consider the value of non-liquid assets, like your home or car.

Common Mistakes People Make with Net Worth

Now, let’s talk about the mistakes people make when it comes to net worth. These are the pitfalls that can trip you up if you’re not careful.

One of the biggest mistakes is focusing too much on income. Just because you make a lot of money doesn’t mean you have a high net worth. If you’re spending more than you earn, your net worth will suffer. Another common mistake is ignoring debt. People often underestimate the impact of debt on their financial health, and that can lead to trouble down the road.

Avoiding the Pitfalls

Here’s how you can avoid these mistakes:

- Live below your means—spend less than you earn.

- Prioritize paying off high-interest debt.

- Invest in assets that appreciate in value.

Building Your Net Worth

Building net worth is all about making smart financial decisions. It’s about saving, investing, and growing your wealth over time. But where do you start?

First, create a budget. Yes, I said it—a budget. It’s the foundation of financial success. Know where your money is going and make adjustments as needed. Next, focus on increasing your income. Whether it’s through a side hustle, a raise, or a new job, every extra dollar counts.

Strategies for Growth

Here are some strategies to help you build your net worth:

- Automate your savings—set it and forget it.

- Invest in the stock market, real estate, or other assets.

- Minimize unnecessary expenses—cut the cable, skip the lattes.

Investing for Net Worth Growth

Investing is one of the most powerful ways to grow your net worth. Whether you’re investing in stocks, bonds, real estate, or even cryptocurrencies, the key is to start early and stay consistent.

Here’s a little secret—time is your greatest ally when it comes to investing. The earlier you start, the more time your money has to grow. Compound interest is a beautiful thing, and it can turn even small investments into big payoffs over time.

Investment Options to Consider

Here are a few investment options to consider:

- Stock Market: High potential for growth, but comes with risks.

- Real Estate: A solid investment for long-term appreciation.

- Bonds: Lower risk, but also lower returns.

Net Worth and Your Lifestyle

Your net worth is closely tied to your lifestyle. The way you live, the choices you make, and the values you prioritize all impact your financial future. That’s why it’s important to align your lifestyle with your financial goals.

For example, if your goal is to retire early, you might need to make some sacrifices now to achieve that. But if you’re happy living paycheck to paycheck, that’s okay too—just be aware of the trade-offs.

Living Within Your Means

Here’s the bottom line—living within your means is the key to building net worth. It’s about making conscious choices about how you spend your money and prioritizing what truly matters to you.

Celebrity Net Worth: Lessons to Learn

Let’s talk about celebrities for a moment. We all love to ogle at their lavish lifestyles and astronomical net worths, but what can we learn from them? Here’s a little table to give you a glimpse:

| Name | Net Worth | Source of Wealth |

|---|---|---|

| Elon Musk | $270 billion | Tesla, SpaceX |

| Oprah Winfrey | $2.7 billion | Media, Investments |

| Taylor Swift | $900 million | Music, Branding |

What can we learn from these folks? For starters, they’ve all built their wealth through hard work, smart investments, and a focus on their passions. They didn’t get there overnight—it took years of dedication and perseverance.

Key Takeaways

Here are a few key takeaways from celebrity net worth:

- Focus on what you’re passionate about.

- Invest in yourself and your skills.

- Don’t be afraid to take calculated risks.

Setting Net Worth Goals

Setting net worth goals is crucial if you want to build wealth. It’s like setting a destination for your financial journey. But how do you set realistic goals?

Start by defining what financial success means to you. Is it a certain number in your bank account? Is it the ability to travel the world? Or is it simply having peace of mind? Once you know what you’re aiming for, you can create a plan to get there.

Creating a Roadmap

Here’s how you can create a roadmap for your net worth goals:

- Set short-term and long-term goals.

- Break your goals into actionable steps.

- Track your progress regularly.

Conclusion

Alright, let’s wrap this up. Understanding "see the way I see net worth" is about more than just numbers—it’s about building a life that reflects your values and priorities. By calculating your net worth, avoiding common mistakes, and making smart financial decisions, you can create a future that’s financially secure and personally fulfilling.

So, what’s next? Take action! Calculate your net worth, set your goals, and start building the financial future you’ve always dreamed of. And don’t forget to share this article with your friends and family—knowledge is power, and the more people who understand net worth, the better off we all are.

Remember, your net worth is a journey, not a destination. Keep learning, keep growing, and keep chasing your dreams. You’ve got this!

- Movierulz Telugu 2024 Your Ultimate Guide To The Latest Telugu Movie Scene

- Mp4moviez Com Your Ultimate Guide To Streaming Movies Online

Free Net Worth Calculator Google Sheets, Excel

Steve Harvey 2024 Networth Net Worth Joly Thomasa

About See The Way I See SEE THE WAY I SEE